- You are here:

- Home »

- Blog

January 2017 – Your IRS Questions Answered Here …

Question: I was self-employed and haven’t been able to pay my taxes for 3 years. Now I’m a W-2 employee but I’m getting letters from the IRS demanding payment and threatening to garnish my paycheck. What should I do?

Answer: The IRS doesn’t like being ignored and they want you to know they won’t go away. They have a lot of power over your life. They have 10 years to collect from the date you filed your return. Not only can they freeze your bank accounts, but can seize the money in those accounts! They can also garnish your wages and legally take as much as 75% of your net paycheck. Besides slapping on Bank Levies and Wage Garnishments, they can put a lien on your house and other property.

August 19, 2016 – Your IRS Questions Answered Here …

Question: I own a small business and in order to keep afloat, I did not send the IRS my employee’s withholding taxes for a few years. How much trouble will I be in?

Answer: Owing 941 payroll taxes is very different from owing personal income taxes. Not only can the IRS padlock the doors to your business, they can come after you personally, levy your bank accounts, confiscate your receivables and seize your property. Scarier still is that it could turn into a criminal matter. Why? Because the money has already been deducted from your employee’s payroll checks; so it’s not your money to begin with! The IRS will look at it as if you stole their money. Payroll tax delinquency is the IRS’s number one enforcement priority.

August 2016 – Your IRS Questions Answered Here …

Question: I received a Notice of Federal Tax Lien via certified mail for unpaid taxes and I’m scared and don’t know what to do. How do I get this situation resolved?

Answer: A Notice of Federal Tax Lien (NFTL) is public record and is generally filed with the County Recorder where you reside. Since a federal tax lien is public record the Lien filing is also reflected on your credit report.

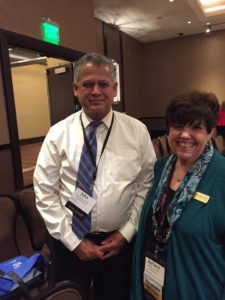

Fellow at NTPI (National Tax Practice Institute)

I was in Las Vegas last week attending the NAEA’s national conference (held at the Cosmopolitan resort and casino). After completing Level 3 of the NTPI (National Tax Practice Institute) pro gram I became a “NTPI Fellow”.

gram I became a “NTPI Fellow”.

We are open for business !

Olympic Tax Resolution LLC doing business as “Olympic Tax Relief” is now open for business.

We provide IRS Tax resolution services for tax payers who want to settle their back taxes and IRS debt. Check out the “Tax Resolution Roadmap“.